New Tax Credit for Auto Loan Interest

What to know about the new IRS Tax Credit for Auto Loan Interest

The IRS has announced a new tax credit for the 2025 tax year that may allow eligible borrowers to receive a credit for certain interest paid on passenger vehicle loans. Below is a general overview of what this credit includes and which loans may qualify.

What Vehicle Loans May Qualify?

Not all vehicle loans are eligible. To qualify for this new tax credit, the loan must meet all of the following requirements:

1. Eligible Passenger Vehicle Types

The loan must be for a passenger vehicle, including:

-

Car

-

Minivan

-

SUV

-

Pick-up truck with a gross vehicle weight under 14,000 lbs

-

Motorcycle

Only personal-use vehicles qualify. Loans for vehicles used for commercial purposes are not eligible.

2. Final Assembly in the United States

The vehicle’s final assembly must have occurred in the United States.

This information can be verified by searching the vehicle’s VIN on the National Highway Traffic Safety Administration (NHTSA) website.

3. New Vehicle Purchases Only

-

The vehicle must be purchased new

-

Used vehicle loans do not qualify

-

Leased vehicles are not eligible

How to locate total interest paid in 2025

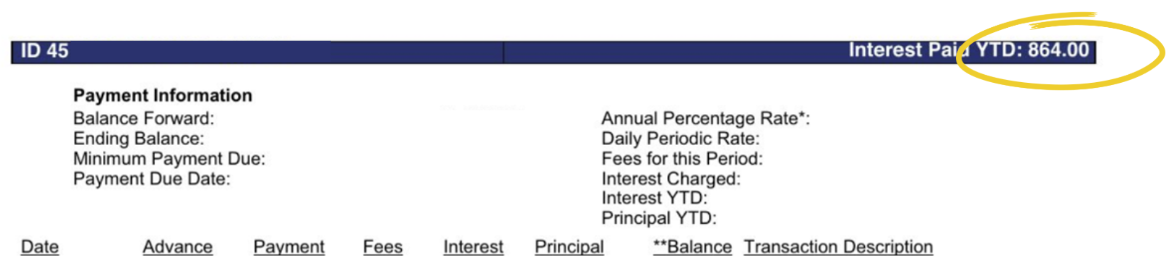

Total interest paid on a vehicle loan can be located on your final loan statement for 2025:

-

Locate the section specific to your loan

-

Find the line labeled Interest Paid Year-to-Date (YTD)

Learn More from the IRS

Complete details can be found on the IRS website.

-

Go to the Individuals section

-

Expand “No Tax on Car Loan Interest (Section 70203)”

Important Disclosure

While general information may be shared, Members First Credit Union does not provide tax advice. Members with questions about eligibility, qualifications, or how this credit applies to their individual situation should consult a qualified tax advisor.

« Return to "M1 Blog"